Real Property Tax 2025/Real Property Valuation and Assessment Reform Act (RPVARA): Latest Updates on RA 12001 and Its IRR.

- CHLP REALTY

- Aug 24, 2025

- 5 min read

The Real Property Tax 2025 landscape in the Philippines is undergoing major changes with the full implementation of Republic Act No. 12001, also known as the Real Property Valuation and Assessment Reform Act (RPVARA).

This landmark legislation aims to make real property taxation more transparent, fair, and standardized across all Local Government Units (LGUs).

On December 10, 2024, the Implementing Rules and Regulations (IRR) of RA 12001 were signed by the Secretary of Finance.

The IRR was published on December 27, 2024 and became effective on January 11, 2025. This means that reforms in real property valuation and tax assessment are now in full motion.

Real Property Tax 2025 IRR of RA 12001 (RPVARA) — Key Highlights & Status.

1. Promulgation and Effectivity

The IRR of RA 12001 was signed by the Secretary of Finance on December 10, 2024.

It was published in a newspaper of general circulation on December 27, 2024, and became effective on January 11, 2025, which is 15 days after publication.

2. Key Provisions in the IRR (in line with what’s laid out in RA 12001)

Establishes the Real Property Valuation Service (RPVS) under the Bureau of Local Government Finance (BLGF) to develop and implement Philippine Valuation Standards (PVS), guide LGUs in preparing Schedule of Market Values (SMVs), and enforce compliance.

LGUs must set up their own Real Property Valuation Units (RPVUs) under local assessors within two years.

The IRR details processes for SMV preparation, including timelines, public consultations, publication, BLGF review, and approval by the Secretary of Finance.

3. Tax Amnesty Provisions

Section 30 of RA 12001 grants a two-year real property tax amnesty, covering penalties, surcharges, and interest on unpaid taxes (including Special Education Fund, idle land tax, and other special levies) due before the Act’s effectivity.

According to a BLGF circular (Memorandum Circular No. 001‑2025, dated January 6, 2025):

The amnesty period runs until July 5, 2026, as the law became effective on July 5, 2024.

Property owners may settle delinquent taxes either via one-time payment or installment, depending on whether the LGU has passed an enabling ordinance. Even absent such ordinance, the amnesty should proceed without delay.

Real Property Tax 2025: Key Features of the IRR of RA 12001

The IRR of RA 12001 sets the guidelines for LGUs, the Bureau of Local Government Finance (BLGF), and property owners.

Below are its highlights:

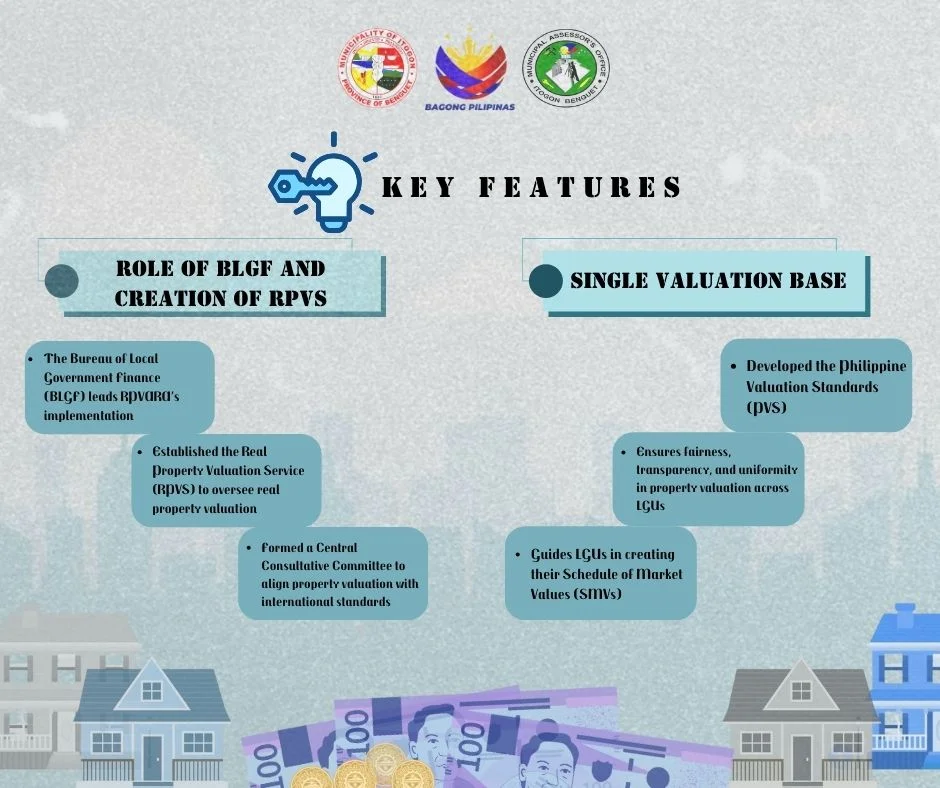

1. Creation of the Real Property Valuation Service (RPVS)

A Real Property Valuation Service (RPVS) is now established under the *BLGF.

This unit is tasked to:

Develop and maintain the Philippine Valuation Standards (PVS).

Guide LGUs in preparing their Schedule of Market Values (SMVs).

Review SMVs to ensure uniformity and fairness.

2. Establishment of Local Real Property Valuation Units (RPVUs)

LGUs are required to set up their own Real Property Valuation Units (RPVUs) within two years. These will be under the office of the local assessor and will be responsible for preparing and updating the LGU’s SMVs.

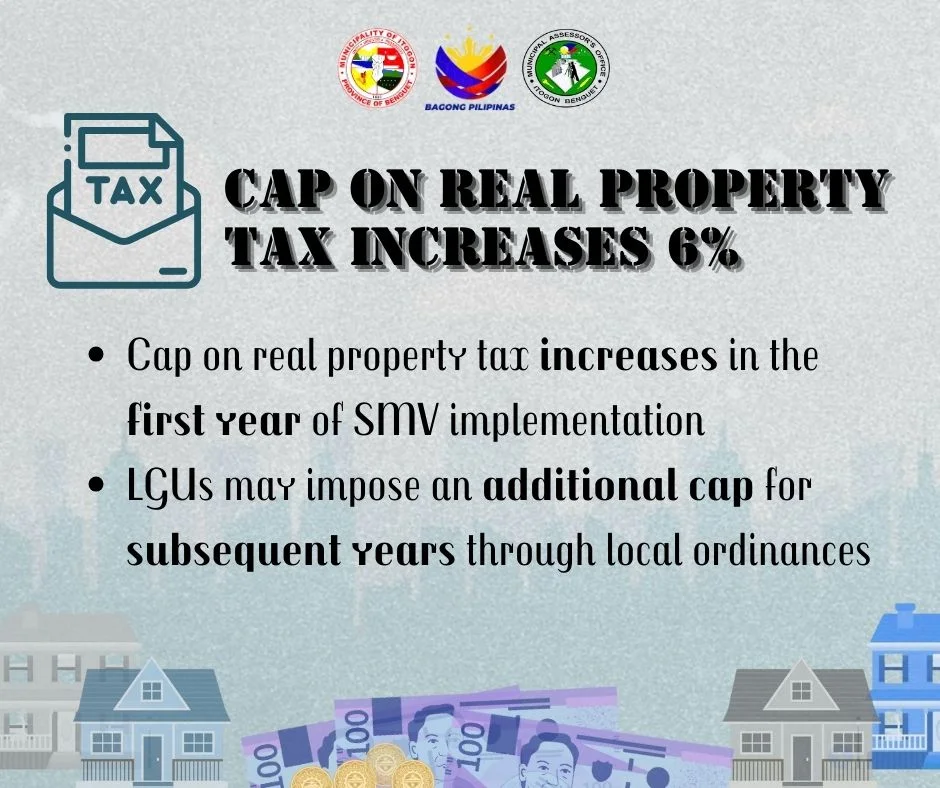

3. Schedule of Market Values (SMVs) Reform

The IRR provides detailed steps for SMV preparation:

Conduct of public consultations and hearings.

Mandatory publication of proposed values.

BLGF review and Secretary of Finance approval.

This will ensure that property valuation is up-to-date and consistent across the country.

The BLGF stands for the Bureau of Local Government Finance.

It is an attached agency of the Department of Finance (DOF) tasked with strengthening local government fiscal administration. In simple terms, BLGF helps LGUs (cities, municipalities, provinces) manage and improve their revenue generation—especially from local taxes, fees, and charges.

Main Functions of BLGF:

Oversees Real Property Tax (RPT) administration nationwide.

Reviews and approves the Schedule of Market Values (SMVs) prepared by LGUs.

Issues guidelines, circulars, and policies on local taxation and assessment.

Provides technical assistance and training to local treasurers and assessors.

Monitors LGU fiscal performance and debt management.

With RA 12001 (Real Property Valuation and Assessment Reform Act), the BLGF plays an even bigger role by:

Establishing the Real Property Valuation Service (RPVS).

Ensuring that property valuations follow Philippine Valuation Standards (PVS).

Guiding LGUs in setting up their Real Property Valuation Units (RPVUs).

👉 In short, BLGF is the national government’s arm to make sure real property taxation and valuation are fair, uniform, and transparent across the Philippines.

Real Property Tax Amnesty 2025 – A Two-Year Window.

One of the most important features of RA 12001 is the Real Property Tax Amnesty:

Covers penalties, surcharges, and interest on unpaid taxes due before July 5, 2024.

Amnesty runs for two years, from July 5, 2024 until July 5, 2026.

Applies to Real Property Tax (RPT), Special Education Fund tax, idle land tax, and other levies.

Payment can be made one-time or by installment, depending on the LGU ordinance.

👉 Even if an LGU has not yet passed an enabling ordinance, the law states that the amnesty should still proceed without delay.

This is a golden opportunity for property owners with long-standing delinquencies to clear their records without penalties.

Why Real Property Tax 2025 Matters to Buyers and Investors?

The implementation of the Real Property Tax 2025 reforms is not only beneficial for LGUs but also for property buyers and investors.

Transparency and Fairness – With uniform Philippine Valuation Standards, property buyers can trust that valuations are not arbitrary.

Better LGU Services – Clearing delinquent accounts and updated valuation systems will boost LGU revenues, leading to improved services like roads, healthcare, and schools.

Investor Confidence – Clearer valuation rules reduce uncertainty, making the Philippines more attractive to investors in residential lots, commercial lots, farm lots, and house-and-lot packages.

Practical Tips for Property Owners

1. Take Advantage of the Amnesty

If you have delinquent real property taxes, settle them before July 5, 2026 to avoid penalties.

2. Monitor Your LGU’s SMV Updates

Your property’s future tax assessment will depend on the new Schedule of Market Values your LGU will adopt under RA 12001.

3. Stay Updated with BLGF Announcements

Visit the BLGF website regularly for circulars, guidelines, and updates on the implementation of the IRR.

Real Property Tax 2025

Real Property Valuation and Assessment Reform Act (RPVARA)

Republic Act 12001

The Real Property Tax 2025 reforms under RA 12001 mark a historic milestone in Philippine real estate.

With the IRR now in effect, property valuation will finally be standardized, transparent, and equitable across the country.

For property owners, the two-year amnesty window is a once-in-a-lifetime chance to settle old tax delinquencies without penalties.

For investors, these reforms create a stable and predictable real estate environment, essential for making smart investments in the years ahead.

👉 Whether you own a house and lot near schools, a residential lot near malls and transport hubs, or commercial property in prime locations, this reform impacts you.

Stay informed, take advantage of the amnesty, and watch how these changes reshape the real estate landscape in the Philippines.

Comments